Like a lot of highly-commoditized modern technology that is digital or in the digital ecosystem, batteries - and specifically chemical batteries - play a super vital role in modern life. They’re in everything from cell phones to laptops to vehicles to our electrical grid infrastructure. I’ve recently had the good fortune of touring some of the world’s largest battery cell plants, learning how they are built. The level of automation and process control in this industry are mind-blowing, and super cool.

This week, I’ll break out the basics of how battery cells are made. In the future, I’ll go up the stack into modules, packs, and energy storage systems.

Below is a focus on the most popular class of battery cell chemistry: lithium ion. Lithium-ion batteries, particularly NMC (Nickel Manganese Cobalt) and LFP (Lithium Iron Phosphate), dominate due to their relatively high energy density and rechargeability.

Operation and Components

Before learning how they are made, let’s break down the components and how they generally work.

Chemical batteries operate through “redox” reactions, converting chemical energy into electrical energy. The anode, typically graphite in lithium-ion batteries, undergoes oxidation, releasing electrons, while the cathode, made of materials like LiNiMnCoO2 for NMC types or LiFePO4 for LFP types, undergoes reduction, accepting electrons. The electrolyte, a liquid lithium salt in an organic solvent within the cell, facilitates ion movement, and a separator (between the anode and cathode), often a porous plastic, prevents short circuits between the anode and cathode.

Overview of an LFP type cylindrical cell from ResearchGate, showing the cathode, anode, current collectors that they are deposited on, and separator. A liquid electrolyte fills the remaining space in the “can”.

Chemistries

While there are a bunch of different chemistries in R&D, there are really two major Lithium Ion chemistries in most energy storage applications: LFP and NMC.

NMC: The cathode comprises lithium, nickel, manganese, and cobalt oxides, offering high energy density suitable for EVs. The anode is graphite, with an electrolyte of lithium salt in an organic solvent. NMC batteries typically have relatively high discharge rate characteristics and tend to be more energy-dense (volumetrically and gravimetrically) than LFP. Nickel, manganese, and cobalt are relatively expensive and in particular, cobalt is relatively rare (mostly found in the Congo in Africa). Finally, NMC cells tend to be more prone for thermal runaway and are generally considered less safe.

LFP: Using lithium iron phosphate for the cathode, these are cobalt-free, enhancing safety and cycle life. They are however less energy-dense, and historically have been used in less energy sensitive applications such as stationary storage, but this is changing with more modern chemistries. Finally, worldwide-abundant iron and phosphate reduce supply risks and costs.

I’ve found radar plots helpful to compare two technologies, like this one from Neexgent.

Form Factors

Lithium-ion batteries are available in three main form factors, each with distinct advantages:

Cylindrical: Resembling traditional AA batteries, these are rolled into a cylindrical shape, like the 18650 cells used in laptops and power tools. They offer dimensional stability (cells grow as they are cycled, but the cylindrical can minimizes that) and are easy to manufacture.

Prismatic: Flat and rectangular, these are common in automotive applications, providing efficient space utilization in EVs and stationary energy storage devices.

Pouch: Flexible and lightweight, pouch cells are used in smartphones and some EVs, offering design flexibility but requiring support structures due to swelling with cycling. Pouch cells are typically less robust to mechanical harm, resulting in typically less safe packs than alternate form factors.

The choice for an engineer designing a battery pack surrounds energy density, thermal management, safety and supply chain availability.

Production of Cells

Alright, let’s get into how these are made, from the mine to shipping to the customer.

Raw Material Mining

NMC Batteries require nickel (Indonesia, Philippines, Russia), manganese (South Africa, Gabon, Australia), cobalt (DRC, accounting for 70% of global supply), and lithium (Chile, Australia, China). However, LFP batteries need lithium (same sources), iron (widely available), and phosphate (China, Morocco, US). As you can see, the location challenges for western battery manufacturers are significant for NMC and much less problematic for LFP.

Worldwide, there are a few large sources for the aforementioned materials:

Lithium: Greenbushes mine in Australia by Albemarle

Cobalt: Tenke Fungurume and Kisanfu mines in DRC by CMOC, a huge Chinese mining co

Nickel: Weda Bay Project in Indonesia by Tsingshan, the largest nickel producer in the world, also a Chinese company

Manganese: Tshipi Borwa mine in South Africa by Jupiter Mines

Phosphate: the Aurora mine in North Carolina is the largest in the world

If you can’t tell, most of this world is dominated by Chinese companies. A theme that continues below…

The Weda Bay nickel mine in Indonesia, majority owned by Chinese company Tsingshan

Electrodes: Cathode and Anode Production

The production of electrodes involves several precise steps:

Slurry Preparation: Active materials (LiNiMnCoO2 for NMC cathodes, LiFePO4 for LFP, and graphite for anodes) are mixed with a binder, and solvent to form a slurry.

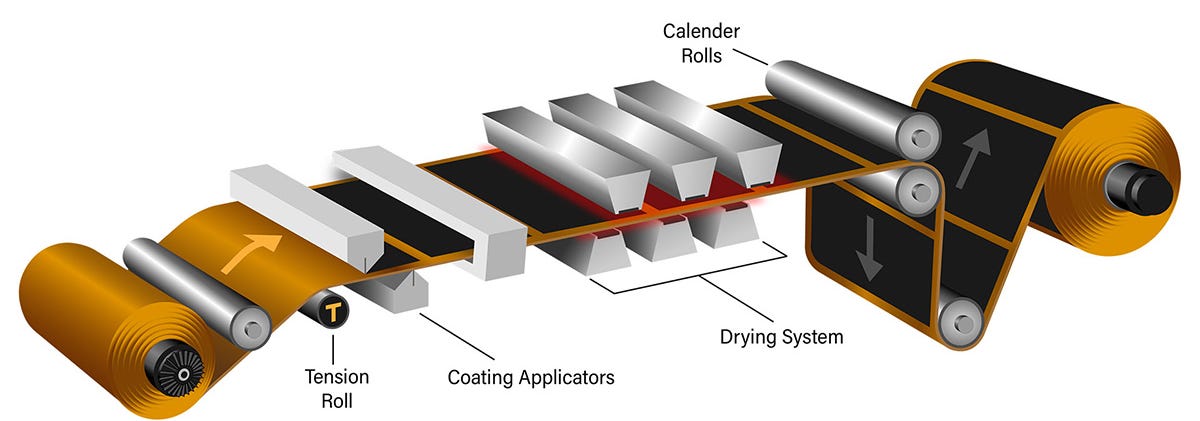

Coating: this slurry is then coated onto metal foils aluminum for cathodes, copper for anodes. The thickness of coating and evenness across the width and length of the roll is super critical.

Drying: The coated foils are dried in controlled environments to remove the solvent, forming a porous electrode layer, often using heated ovens to prevent defects.

Calendaring: The dried electrodes are pressed through rollers to achieve the desired thickness and density, enhancing electrical contact and energy density. This specific process is one of the more sensitive in the whole production line, and often held as the core process knowledge held by many cell companies.

Coating, Drying, and Calendaring process visual by Dover Flexo

A completed cathode roll

Making the “Jellyroll”

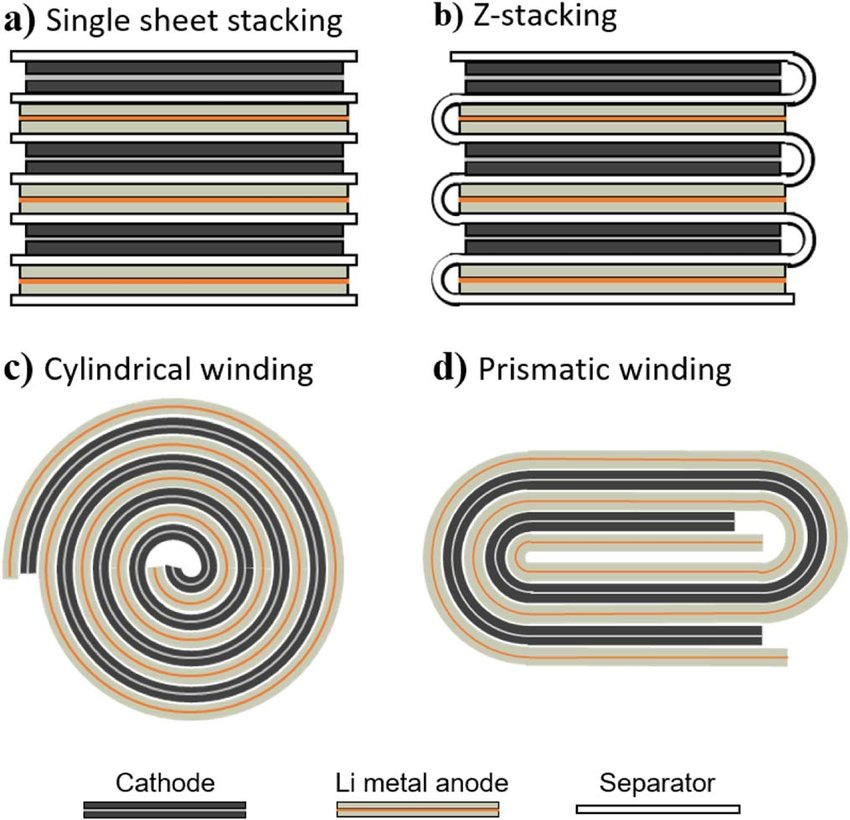

The “jellyroll” is the assembly of the cathode, anode, and separate material. This represents the majority of the mass and all of the energy-storage medium in the cell. In high volume cell manufacturing, this process involves a huge amount of complex automation to cut, align, wind, and fold the materials, all of which happens from rolls of materials as pictured above.

Most batteries use winding, however cells that are used in higher power applications can use a stacking methodology, described in the image below:

I’d highly recommend watching this video to understand how it all works.

Cell Can Insertion and Electrolyte Filling

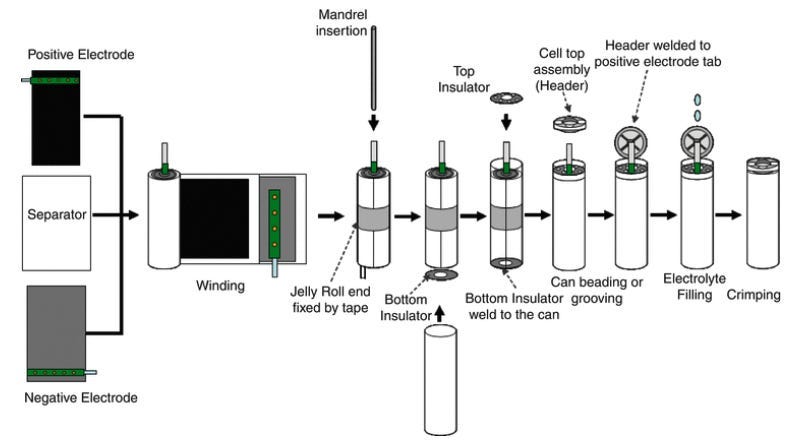

Next, the jellyroll is inserted in the can, box, or pouch (depending on cell type). Afterwards, the can is sealed, and the cell is filled with electrolyte. All of this is done in an automated fashion, with leak check steps often using helium gas completed along the way.

The winding and cell assembly steps, described in the Intercalation substack

Quality Checking and Formation

The cell is now physically complete. A few more steps are used to ensure performance and check for defects via electrical tests: Measuring capacity, voltage, and internal resistance and mechanical tests: checking dimensions and weight.

Formation Process

Formation involves initial charging and discharging at low rates to stabilize the battery's chemistry, forming the solid electrolyte interphase (SEI) layer on the anode. This process is detailed in Battery Formation and Testing, can take days and is sensitive to temperature, affecting cycle life. This is typically done in huge automated heated racked chambers such as this:

Manufacturers: It's Basically All in China

All of the above, in particular for LFP chemistries, is almost entirely completed in China. China doesn’t just control a large portion of the industry, they control basically the whole raw material, refining, anode + cathode production, and cell assembly process. Why? I think there’s a few reasons:

Local supply chain: like most industries that China has the upper hand in manufacturing in, the whole supply chain from mining to the cell can manufacturing, to the designers and producers of the automated equipment are all within that country.

Process knowledge: the Chinese have perfected the very finely-tuned process control required to make LFP. In particular, in the cathode and anode production process requires significant process parameter knowledge which really only comes from years of data collection.

Economies of Scale: the recently-anointed large players such as CATL, BYD, REPT, and others have huge economies of scale (these are multi-billion dollar plants) that make it hard for startups - especially those outside of China - to compete.

This is a pie chart representing the *worldwide* share of the LFP battery market. Every single listed company outside of the “other” category is Chinese. CATL and BYD dominate the market for LFP.

This same chart for all lithium (inclusive of NMC) will show the Korean manufacturers Samsung and LG with 10%+ market share. Source

Banger